Payments, Deductions and Superannuation data for each employee is automatically sent to the ATO when you finalize each payrun. Employers, using the same or different payroll systems, will often use a different name for the same type of payment or deduction.

Although this name may be sufficient on a pay slip for the employee to understand what the amount was for, the ATO systems have no way of deducing this, or of knowing that hundreds of different names from different employees and payroll systems were all related to exactly the same type of payment or deduction.

To overcome this, the ATO has issued a standard list of STP reporting codes that provide a single code for each type of payment and deduction.

Employers can continue using the same names they have always used but must add the appropriate STP reporting code to each payment type and deduction type in their payroll system.

These standard codes are automatically attached to every amount sent to the ATO, rather than the name printed on pay slips, enabling the ATO systems to understand exactly what each amount was for and to apply the appropriate taxation and processing.

For expert guidance, please consult the ATO, Fair Work Ombudsman, your employer association or a qualified tax accountant about:

- Employee payments (types and amounts)

- Tax withholding requirements

- STP codes for ATO submissions

Adding STP Codes

You need to select the appropriate STP code(s) on each payment type (Earnings Types and Allowance Types) and Deduction Type in Marlin HR as shown below.

We have integrated the codes into Marlin HR so that you can select them from drop-down lists.

We have also included a Hint beside each field that you can click on to display information about the codes.

In addition, there are some reporting codes that you must select on each employee that will enable the ATO system to determine whether the appropriate tax is being withheld.

Earnings vs Allowances

The ATO differentiates between regular payments (known as Earnings Types in Marlin HR) and allowances (known as Allowance Types in Marlin HR) and has provided a different set of STP reporting codes for each. Y

ou must therefore create the correct type of payment (i.e. Earnings Type or Allowance Type) in Marlin HR so as to be able to select the correct reporting code.

This was not important prior to Phase 2 of STP reporting and some payment types were commonly created in Marlin HR as Allowance Types instead of Earnings Type (e.g. Bonus, Commission).

In preparing for STP reporting (Phase 2) employers had to discontinue these allowance types and create earnings types to replace them.

We have provided a table of payments below that indicates whether each particular type of payment needs to be set up in Marlin HR as an Earnings Type or an Allowance Type.

The ATO separates payments into "Allowances" and other payments, providing a different set of STP-2 reporting codes for each payment type. It is therefore important to set up each payment correctly in Marlin HR as an "Allowance" type or an "Earnings" type so that the appropriate STP-2 reporting code can be selected on it.

Prior to STP-2, it did not matter whether some payment types (eg. Bonuses, Commissions, Directors Fees, Community Service, Jury Duty, Workers Compensation Leave, Paid Parental Leave) were set up as "Allowance" types or "Earnings" types as they were not separated out from other payments in the reporting to the ATO.

However, as the ATO does not classify these particular payments as "Allowances", the STP-2 reporting codes it has provided for them are available on "Earnings" types and not "Allowance" types. As part of the migration to STP-2 reporting, customers that previously had these payments set up as "Allowance" types had to set them as inactive and re-create them as "Earnings" types so they could select the required STP-2 reporting codes.

The following section shows the STP-2 reporting codes provided by the ATO for Earnings types and for Allowance types and will help you to determine which type you should set up for a particular payment.

Below that is a table containing many common payment types and indicating how each one should be set up in Marlin HR so it is reported correctly to the ATO.

Earnings Types

Create Earnings types for payments that are not classified by the ATO as an "Allowance".

To edit or add Earnings types, select System > Earnings from the menu in Marlin HR. Double-click on an Earnings type in the list to edit it, or click on the Add icon to add a new one.

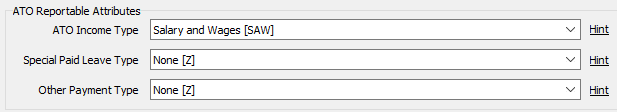

On each Earnings type there is a section titled ATO Reportable Attributes where you need to select the appropriate STP-2 reporting codes for this payment.

ATO Income Type: In this field you will always select Salary & Wages unless this payment type is to be used for a Working Holiday Maker.

The next 2 fields provide STP-2 reporting codes for a number of payment types.

If neither provide an appropriate option, select None in both of them (eg. for Standard Hours), otherwise select the appropriate option in one of them and select None in the other one.

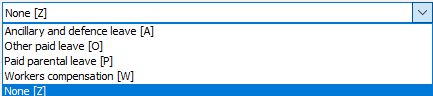

Special Paid Leave Type:

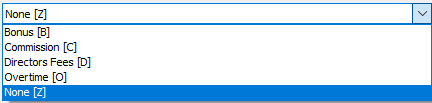

Other Payment Type:

Click on Hint beside a field to display an explanation of each option.

Allowance Types

Create an "Allowance" type for payments that are classified by the ATO as an "Allowance".

To edit or add Allowance types, select System > Allowances from the menu in Marlin HR. Double-click on an Allowance type in the list to edit it, or click on the Add icon to add a new one.

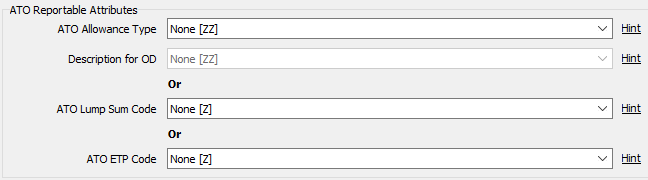

On each Allowance type there is a section titled ATO Reportable Attributes where you need to select the appropriate STP-2 reporting codes for this payment.

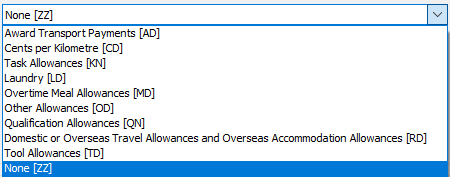

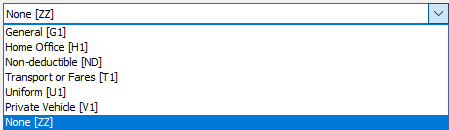

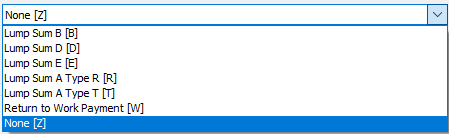

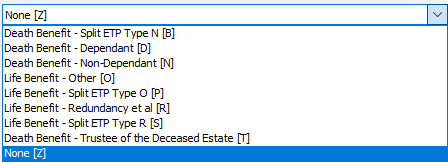

The next 4 fields provide STP-2 reporting codes for different types of Allowances. You should refer to the ATO website or the table in the section below to determine the correct options to select for each type. Clicking on Hint beside a field will also provide additional explanation of the options.

If unsure, do not just select Other Allowances and General in the top 2 fields. The ATO has specifically warned employers not to use these options as a "catch all".

If the payment is for a Lump Sum Code or ETP Code, select the appropriate option in one of the bottom 2 fields and select None in the others.

If the appropriate option is in the first box, select it there and select None in all other fields.

If the correct option is Other Allowances in the top field, you will then need to make an appropriate selection in the second field as well to provide further detail.

ATO Allowance Type:

Description for OD:

ATO Lump Sum Code:

ATO ETP Code:

Payments & STP-2 Codes

Shown below are a number of common payment types with an indication of whether they should be set up in Marlin HR as an Earnings type or Allowance type and which STP-2 reporting codes should be selected.

Please verify the recommended STP-2 reporting codes with the ATO or your tax accountant.

Allowences

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Allowance – accommodation – domestic, amount does not exceed ATO reasonable amount | Allowance | Not reported |

| Allowance – accommodation – domestic, amount exceeds ATO reasonable amount | Allowance | Domestic or overseas travel allowances and overseas accommodation (allowance type RD) |

| Allowance – accommodation – overseas, for business purposes | Allowance | Other allowances (allowance type OD) with the description G1 (General) |

| Allowance – accommodation – overseas, for private purposes | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – all-purpose | Allowance | Task allowances (allowance type KN) |

| Allowance – car – flat rate | Allowance | Other allowances (allowance type OD) with the description V1 (Private vehicle) |

| Allowance – cents per km – for a car in excess of the ATO rate for business related travel. | Allowance | Cents per km allowance (allowance type CD) |

| Allowance – cents per km – for a car up to the ATO rate for business related travel | Allowance | Cents per km allowance (allowance type CD) |

| Allowance – cents per km – for private travel such as travel between home and work. | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – cents per km – for vehicles other than a car such as a motorbike or van. | Allowance | Other allowances (allowance type OD) with the description V1 (Private vehicle) |

| Allowance – confined spaces | Allowance | Task allowances (allowance type KN) |

| Allowance – danger | Allowance | Task allowances (allowance type KN) |

| Allowance – dirt | Allowance | Task allowances (allowance type KN) |

| Allowance – district | Allowance | Task allowances (allowance type KN) |

| Allowance – driving licence | Allowance | Qualification and certification allowances (allowance type QN) |

| Allowance – equipment – where equipment is supplied by employee for business purposes | Allowance | Tool allowances ( |

| Allowance – first aid | Allowance | Task allowances (allowance type KN) |

| Allowance – freezer | Allowance | Task allowances (allowance type KN) |

| Allowance – height | Allowance | Task allowances (allowance type KN) |

| Allowance – higher duties | Allowance | Task allowances (allowance type KN) |

| Allowance – home office equipment | Allowance | Other allowances (allowance type OD) with the description H1 (Home office) |

| Allowance – industry | Allowance | Task allowances (allowance type KN) |

| Allowance – Internet | Allowance | Other allowances (allowance type OD) with the description H1 (Home office) |

| Allowance – laundry – for cleaning of approved uniforms in excess of the ATO approved limit. | Allowance | Laundry allowance (allowance type LD) |

| Allowance – Laundry – for cleaning of approved uniforms up to the ATO approved limit | Allowance | Laundry allowance (allowance type LD) |

| Allowance – laundry – for the cost of laundering deductible conventional clothing | Allowance | Other allowances (allowance type OD) with the description G1 (General) |

| Allowance – laundry – for the cost of laundering uniforms for private purposes | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – leading hand | Allowance | Task allowances (allowance type KN) |

| Allowance – liquor licence | Allowance | Qualification and certification allowances (allowance type QN) |

| Allowance – living away from home (FBT) | Allowance | Not reported – but may form part of RFBA |

| Allowance – locality | Allowance | Task allowances (allowance type KN) |

| Allowance – loss of licence | Allowance | Qualification and certification allowances (allowance type QN) |

| Allowance – meals and incidentals – domestic, amount does not exceed ATO reasonable amount. | Allowance | Not reported |

| Allowance – meals and incidentals – domestic, amount exceeds ATO reasonable amount | Allowance | Domestic or overseas travel allowances and overseas accommodation (allowance type RD) |

| Allowance – meals and incidentals – overseas, amount exceeds ATO reasonable amount | Allowance | Domestic or overseas travel allowances and overseas accommodation (allowance type RD) |

| Allowance – on call – ordinary hours | Allowance | Task allowances (allowance type KN) |

| Allowance – on call – outside ordinary hours | Earnings | Overtime (other payment type O) |

| Allowance – overtime meals – amount does not exceed the ATO reasonable amount | Allowance | Not reported |

| Allowance – overtime meals – amount exceeds the ATO reasonable amount | Allowance | Overtime meal allowance |

| Allowance – recognition of skill level | Allowance | Task allowances (allowance type KN) |

| Allowance – secondment | Allowance | Task allowances (allowance type KN) |

| Allowance – site | Allowance | Task allowances (allowance type KN) |

| Allowance – supervisor | Allowance | Task allowances (allowance type KN) |

| Allowance – tools of trade | Allowance | Tool allowances (allowance type TD) |

| Allowance – transport – for private purposes | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – transport – payments for the cost of transport for business related travel not traceable to a historical award in force on 29 October 1986 | Allowance | Other allowances (allowance type OD) with the description T1 (fares) |

| Allowance – transport – payments for the cost of transport for business related travel traceable to a historical award in force on 29 October 1986 | Allowance | Award transport payments (allowance type AD) |

| Allowance – travel time – ordinary hours | Earnings | Gross (other payment type None) |

| Allowance – travel time – outside ordinary hours | Earnings | Overtime (other payment type O) |

| Allowance – travel – for private purposes | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – travel – part day | Allowance | Other allowances (allowance type OD) with the description ND (non-deductible) |

| Allowance – wet weather | Allowance | Task allowances (allowance type KN) |

| Allowance – working with children check | Allowance | Qualification and certification allowances (allowance type QN) |

Earnings

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Ordinary hours | Earnings | Gross (other payment type None) |

| Overtime | Earnings | Overtime (other payment type O) |

| Penalties – public holiday | Earnings | Gross (other payment type None) |

| Penalties – shift | Earnings | Gross (other payment type None) |

| Public holiday – day not worked | Earnings | Report as if the employee had worked (Gross and any other relevant payment types) |

| Rostered day off (RDO) – hours cashed out in service | Earnings | Leave type C - Note: Adjustment Leave Entries with "Cash-in Leave Hours" checkbox ticked will do this automatically. |

| Rostered day off (RDO) – hours taken | Earnings | Other paid leave (paid leave type O) |

| Time off in lieu (TOIL) – hours cashed out in service | Earnings | Overtime (other payment type O) |

| Time off in lieu (TOIL) – hours taken | Earnings | Other paid leave (leave type O) |

| Travel time – Excess, for travel outside ordinary hours | Earnings | Overtime (other payment type O) |

| Breach of rest break payment | Earnings | Gross (other payment type None) |

| Call back payment | Earnings | Overtime (other payment type O) |

| Commission | Earnings | Commission (other payment type C) |

| Directors’ fees – working or non-working director | Earnings | Directors’ fees (other payment type D) |

| Flexi time – hours worked and taken | Earnings | Gross (other payment type None) |

| Identifiable overtime component of annualised salary | Earnings | Overtime (other payment type O) |

Back Pay

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Back pay – accrued less than 12 months before date of payment | Allowance / Earnings | The payment type that matches the payment. For example, back pay of ordinary pay = gross, back pay of higher duties allowance = task allowance (allowance type KN). |

| Back pay – accrued more than 12 months before date of payment | Allowance | Lump sum E |

| Back pay – total is below Lump sum E threshold | Allowance / Earnings | The payment type that matches the payment. For example, back pay of ordinary pay = gross, back pay of higher duties allowance = task allowance (allowance type KN). |

Bonuses

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Bonus – Christmas | Earnings | Bonus (other payment type B) |

| Bonus – ex-gratia, in respect of ordinary hours of work | Earnings | Bonus (other payment type B) |

| Bonus – paid to employee that has resigned to encourage withdrawal of resignation | Allowance | Return to work payment (Lump sum W) |

| Bonus – paid to end industrial action | Allowance | Return to work payment (Lump sum W) |

| Bonus – paid to ex-employee to return | Allowance | Return to work payment (Lump sum W) |

| Bonus – performance | Earnings | Bonus (other payment type B) |

| Bonus – referral | Earnings | Bonus (other payment type B) |

| Bonus – relating entirely to time worked outside ordinary hours | Earnings | Overtime (other payment type O) |

| Bonus – retention | Earnings | Bonus (other payment type B) |

| Bonus – sign-on | Earnings | Bonus (other payment type B) |

Leave

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Leave – annual – cashed out in service | Earnings | Leave type C - Note: Adjustment Leave Entries with "Cash-in Leave Hours" checkbox ticked will do this automatically. |

| Leave – annual – taken | Earnings | Other paid leave (paid leave type O) |

| Leave – bereavement | Earnings | Other paid leave (paid leave type O) |

| Leave – carer’s | Earnings | Other paid leave (paid leave type O) |

| Leave – community service | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – compassionate | Earnings | Other paid leave (paid leave type O) |

| Leave – defence | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – domestic violence | Earnings | Other paid leave (paid leave type O) |

| Leave – family | Earnings | Other paid leave (paid leave type O) |

| Leave – firefighting service | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – gardening | Earnings | Other paid leave (paid leave type O) |

| Leave – jury duty | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – long service – cashed out in service | Earnings | Leave type C - Note: Adjustment Leave Entries with "Cash-in Leave Hours" checkbox ticked will do this automatically. |

| Leave – long service – taken | Earnings | Other paid leave (paid leave type O) |

| Leave – paid on termination – annual leave or leave loading accrued after 17 August 1993, termination for genuine redundancy, invalidity or early retirement scheme reasons | Allowance | Lump sum A, type code R |

| Leave – paid on termination – annual leave or leave loading accrued after 17 August 1993 paid on a normal termination | Earnings | Unused leave on termination (paid leave type U). Note: Termination Pay will apply this automatically. |

| Leave – paid on termination – long service leave accrued after 17 August 1993 paid on a normal termination | Earnings | Unused leave on termination (paid leave type U). Note: Termination Pay will apply this automatically. |

| Leave – paid on termination – long service leave that accrued before 16 August 1978 | Allowance | Lump sum B |

| Leave – paid on termination – long service leave that accrued between 16 August 1978 and 17 August 1993. | Allowance | Lump sum A, type code T |

| Leave – paid on termination – unused annual leave or leave loading paid on termination that accrued before 17 August 1993 | Allowance | Lump sum A, type code T |

| Leave – parental – employer paid | Earnings | Paid parental leave (paid leave type P) |

| Leave – parental – government paid (GPPL) | Earnings | Paid parental leave (paid leave type P) |

| Leave – personal – cashed out in service | Earnings | Leave type C - Note: Adjustment Leave Entries with "Cash-in Leave Hours" checkbox ticked will do this automatically. |

| Leave – personal – taken | Earnings | Other paid leave (paid leave type O) |

| Leave – RSPCA | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – sick | Earnings | Other paid leave (paid leave type O) |

| Leave – State Emergency Service (SES) | Earnings | Ancillary and defence leave (paid leave type A) |

| Leave – study | Earnings | Other paid leave (paid leave type O) |

Loading

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Loadings – annual leave loading (demonstrably referable to a loss of overtime) | Earnings | Overtime (other payment type O) |

| Loadings – annual leave loading (standard) | Earnings | Other paid leave (paid leave type O) |

| Loadings – casual loading | Earnings | Gross (other payment type None) |

Workers Compensation

| Payment Type | Earnings / Allowence | STP Pahse 2 Reporting Codes |

|---|---|---|

| Workers’ compensation – no work is performed | Earnings | Workers Compensation W |

| Workers’ compensation – paid after termination | Earnings | Workers Compensation W |

| Workers’ compensation – top-up, no work is performed | Earnings | Workers Compensation W |

| Workers’ compensation – top-up, work is performed | Earnings | Gross (other payment type None) |

| Workers’ compensation – work is performed | Earnings | Gross (other payment type None) |